IRS 8974 2024-2025 free printable template

Show details

17 For Paperwork Reduction Act Notice see the separate instructions. Add lines 8 and 9 g Remaining credit subtract column f 951823 www.irs.gov/Form8974 Cat. No. 37797C Form 8974 Rev. 12-2024. Form Rev* December 2024 Qualified Small Business Payroll Tax Credit for Increasing Research Activities Department of the Treasury Internal Revenue Service Employer identification number EIN OMB No* 1545-0029 Report for this quarter. Check only one box. Name not your trade name 1 January February March...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign credit tax form

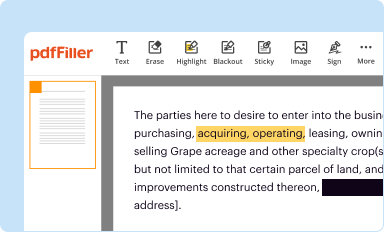

Edit your 8974 for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

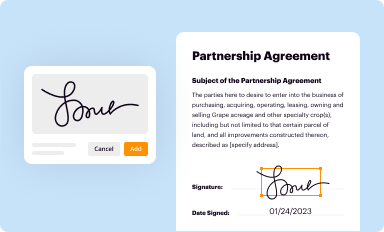

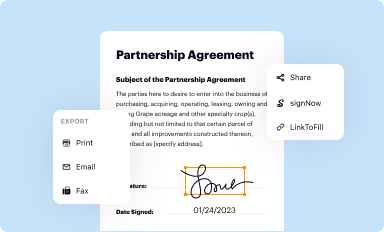

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8974 january form via URL. You can also download, print, or export forms to your preferred cloud storage service.

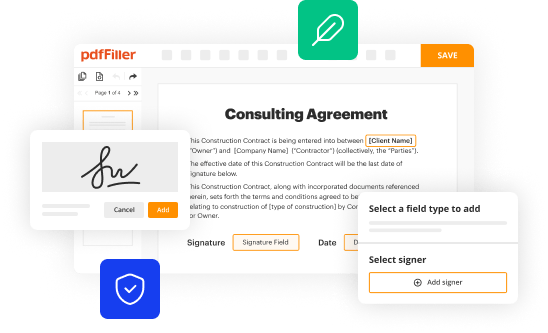

Editing tax return refund online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 8974. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8974 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 8974 form

How to fill out IRS 8974

01

Gather necessary information: Ensure you have all required data, such as the number of qualified employees and benefit information.

02

Download IRS Form 8974: Obtain the latest version of the form from the IRS website.

03

Complete Part I: Enter your employer identification number (EIN) and the tax year.

04

Fill out Part II: Report the number of qualified employees and any adjustments.

05

Calculate the credit: Use the instructions to compute the tax credit you are eligible to claim.

06

Review the form: Double-check all entries for accuracy and completeness.

07

Sign and date: Include your signature and the date at the bottom of the form.

08

Submit the form: File the completed form with your tax return or as instructed.

Who needs IRS 8974?

01

Employers who claim the credit for paid family and medical leave for their employees.

02

Businesses eligible for the Employer Credit for Paid Family and Medical Leave under the Tax Cuts and Jobs Act.

Fill

employee tax

: Try Risk Free

People Also Ask about 8974

Who is eligible for the R&D credit?

Who qualifies for the R&D credit? Any company engaged in activities to develop or improve products, processes, software, formulas, techniques or inventions in a way that required some level of technical experimentation to determine the most accurate and appropriate design may qualify for the R&D credit.

What is 8974 form?

Employers use this form to determine the amount of qualified small business payroll tax credit for increasing research activities they can claim on their employment tax return.

What qualifies for the RD tax credit?

Who qualifies for the R&D credit? Any company engaged in activities to develop or improve products, processes, software, formulas, techniques or inventions in a way that required some level of technical experimentation to determine the most accurate and appropriate design may qualify for the R&D credit.

Who can file form 8974?

Form 8974 is used by small businesses or start-ups to determine the amount of qualified small business payroll tax credits they can claim from their employment tax return on Form 941. Only qualified small businesses that elect to claim payroll tax credits should file Form 8974.

Who is eligible for Schedule R?

You must have been permanently and totally disabled before you retired. You must receive taxable disability income during the year. You must be younger than your employer's mandatory retirement age before the beginning of the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my file late in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax return irs and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get return late?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific taxable tax and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I fill out small tax on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form increasing from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IRS 8974?

IRS 8974 is a form used by certain corporations to claim a credit for their foreign tax payments under section 901 of the Internal Revenue Code.

Who is required to file IRS 8974?

Corporations that have foreign tax credits exceeding a certain threshold are required to file IRS 8974 to properly report the credits.

How to fill out IRS 8974?

To fill out IRS 8974, corporations must gather necessary financial and tax information, accurately complete each section of the form as instructed, and ensure all calculations are correct before submitting.

What is the purpose of IRS 8974?

The purpose of IRS 8974 is to allow corporations to report and claim foreign tax credits, ensuring compliance with tax regulations while minimizing the risk of double taxation.

What information must be reported on IRS 8974?

Information that must be reported on IRS 8974 includes the amount of foreign taxes paid, the type of income on which the taxes were paid, and any necessary corporate identification details.

Fill out your IRS 8974 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

The 8974 is not the form you're looking for?Search for another form here.

Keywords relevant to form 8974 instructions

Related to group tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.